The Big Question for the U.S. Economy: How Much Room Is There to Grow?

The hottest topic for reviewers regarding the United States economy in 2017 and beyond is that whether it will continue to grow this way? How much room is there for his economy to grow?

The nation has continued to expand since last 8 years and is coming to a halt at its full productive capacity. It’s the stage where every citizen has a job, and offices and factories are winding at full speed.

Is the economy almost near to closure?

|

U.S economy is near to the full capacity of its growth. To access how close the economy is to come to a halt, one should look at America’s office complexes and industrial parks. The Federal Reserve surveys the industrial sector by computing factory capacity utilization. U.S companies were running factories at 75.7 percent of their capacity in January for the last five years. In 2007, it was 79.5 percent and above 80 percent in the 1990s. |

Manufacturing sector

Therefore, the manufacturing area would appear to have space to manufacture more stuff even without enlarging factory floors or increasing equipment.

Service sector

| Economic slack is difficult to determining in the service sector. It’s always difficult to judge if an insurance company is working below or at its complete potential. But one way to find this is the office vacancy rate. Around 15.8 percent of office space was available at the end of 2016.This was less from a recent 17.6 percent in 2011. One important point to consider is that development of new office vacancies has relatively decreased since the 2008 slump, which brings up the possibility that the remaining space could be occupied rapidly with a small new supply. |

|

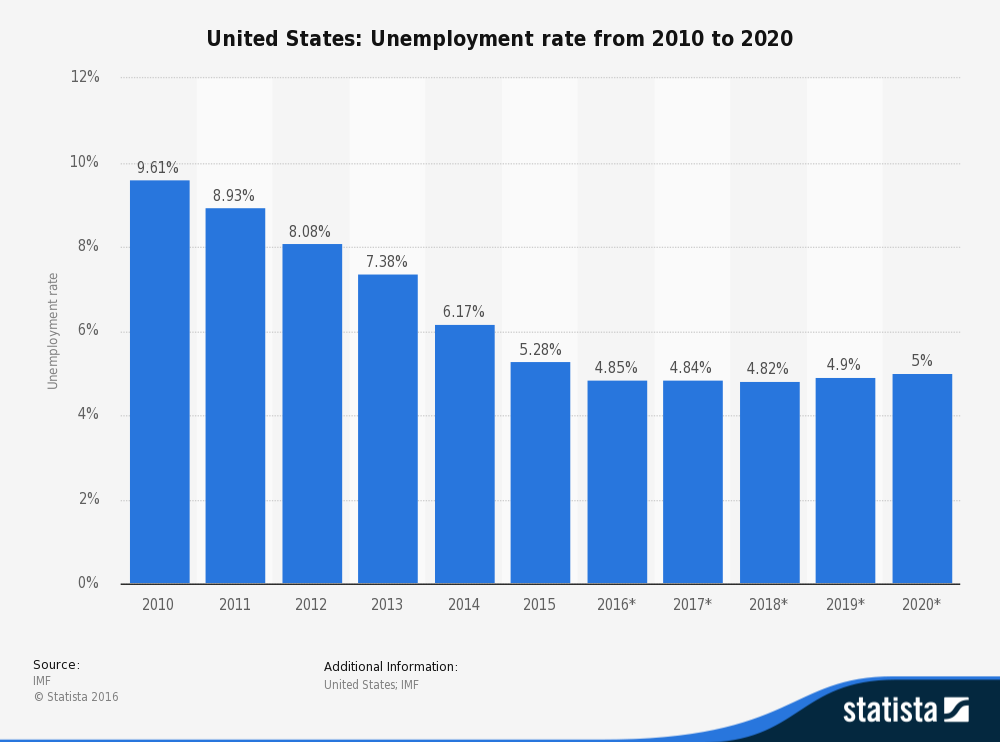

Rate of Unemployment

Supply of workers is the most important factor which will determine how much more room U.S economy has to grow. The most common factor effecting slack in the labor market is the rate of unemployment. And, recent reviews suggest that full employment has very nearly been achieved. The 4.8 percent unemployment rate is accepted as the long-term rate that won’t lead to inflation and U.S economy has reached no less than 4.4.

“Missing” workers

The unemployment rate has a few bends. A huge number of Americans left the labor force completely as a result of the last downturn. Now, these workers are the missing ones. These workers are not counted as unemployed because they are not searching for a job but might be presented to work. These could, in turn, contribute to G.D.P. However, in the real world, things are other way round.

Breaking a Cycle, With Risk

After considering all the above-mentioned points, it becomes very evident that U.S economy is not quite on the verge of breaking down or coming to a halt. However, one thing is also obvious that it also does not offer a huge space for growth.

Therefore, the best discussion for policy makers to be watchful about putting the brakes on economic development with fast Fed interest rate surges is how much we are not aware about why growth has been so unsatisfactory over the past many years.

Let’s have a look at statistics. In 2007, the Congressional Budget Office issued long-term projections of potential G.D.P.that presumed the United States would have an economic upsurge of around 2.7 percent per year for the following decade. However, it didn’t. Growth in both the worker productivity and labor force underperformed those forecasts. Therefore, it is now clear that the existing performance we are delivering underperforms that presumed potential by $2.2 trillion which makes approximately 14 percent.

Possible explanation of underperformance

One most possible explanation of what went wrong with overall economic performance is that the damage of the 2008 downturn had lasting consequences and effects, both drawing some Americans out of the work force and instigating businesses to underinvest in advancements. Reduced demand for services and goods damaged the scope of the economy, leading to a vicious cycle.

If executives at the Fed and in the Trump management try to run the economy a little more vigorously — to keep chasing rapid growth even as the economy gets near or out passes potential G.D.P. — it would play a huge role to make the things reverse, to create a virtuous cycle.

Applying it has the risks of its own. The most possible and big risks include that of inflation, and perhaps new economic bubbles. The substitute is to accept the low-growing world we’ve been living in and take it as an absolute fact of life and mold yourself completely according to it.